![]() Nikolaos Akkizidis

Nikolaos Akkizidis

LegacyFX

Litecoin is considered one of the earliest alternative cryptocurrencies to Bitcoin and is sometimes referred to as "silver to Bitcoin's gold." Litecoin is a peer-to-peer cryptocurrency created in October 2011 by Charlie Lee, a former Google engineer, and designed to improve upon some of the limitations of Bitcoin, providing a faster and more efficient cryptocurrency.

Litecoin has consistently been one of the top cryptocurrencies by market capitalization. While it has faced competition from numerous other cryptocurrencies over the years, it has maintained its position as one of the prominent altcoins.

Litecoin is based on the open-source Bitcoin protocol but has several technical differences. One notable difference is the hashing algorithm used for mining. While Bitcoin uses SHA-256, Litecoin uses a different algorithm called Scrypt, allowing faster block generation.

Thus, it has a faster block generation time compared to Bitcoin. While Bitcoin's average block time is around 10 minutes, Litecoin has a target block time of 2.5 minutes. This faster block time enables quicker transaction confirmations. The total supply of Litecoin is capped at 84 million coins, four times the supply of Bitcoin, which, as is known, has a maximum limit of 21 million. Why 84 and not 21 million? Because in 10 minutes, four blocks of Litecoin come out instead of one of Bitcoin.

The mining process in Litecoin, as in other cryptocurrencies, is crucial in maintaining network security and achieving consensus. Miners compete to find valid hashes, and once a block is mined and added to the blockchain, it becomes part of the immutable ledger. Mining in Litecoin follows a similar concept to Bitcoin mining but as already mentioned, uses a different hashing algorithm called Scrypt, which is more memory-intensive than Bitcoin's SHA-256 algorithm.

The Litecoin network adjusts the mining difficulty level every 2016 blocks (approximately every 3.5 days) to maintain an average block generation time of around 2.5 minutes. If blocks are being mined too quickly, the difficulty increases, making it harder to find a valid hash. Conversely, the difficulty decreases if blocks are mined too slowly, making it easier to find a valid hash.

When miners successfully mine a new block, they are rewarded with a certain number of Litecoins as a block reward. Initially, the block reward was 50 Litecoins, but it reduces by half through a process called halving. As of the most recent halving in August 2019, the block reward stands at 12.5 Litecoins per block. This reward serves as an incentive for miners to contribute their computational power to secure the network.

Halving in Litecoin occurs every 840,000 blocks, which is roughly equivalent to four years based on the target block time of 2.5 minutes. The first Litecoin halving took place on August 25, 2015, and subsequent halving occurred on August 5, 2019, while in a few weeks, on August 04, 2023, we will once again have the halving phenomenon.

The primary purpose of halving is to control the issuance rate of new Litecoins and manage inflation. By reducing the block reward, halving gradually decreases the rate at which new Litecoins are introduced into circulation, ultimately leading to a maximum supply of 84 million Litecoins.

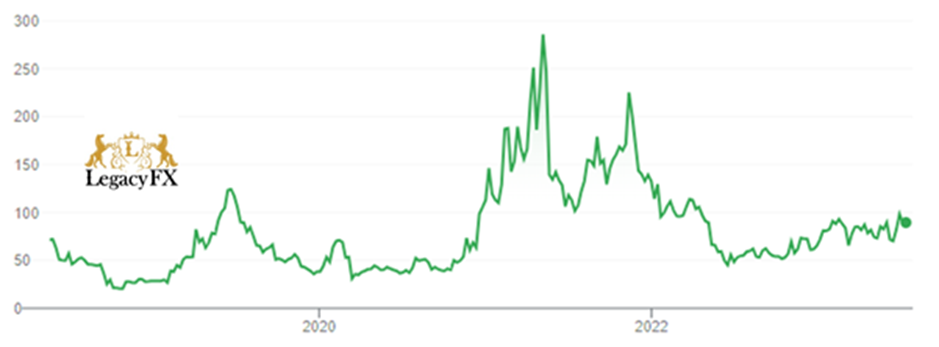

Halving events often generate interest and anticipation in the cryptocurrency community, as they are seen as significant milestones. The reduction in the rate of new Litecoin issuance, coupled with the increasing demand, can potentially lead to scarcity, which, in turn, may positively impact Litecoin's price.

This, coupled with data from on-chain analytics company Santiment, which shows that the total number of large Litecoin wallets, i.e. Litecoin addresses with at least 10,000 coins, has increased in recent months, is likely to attest to Litecoin's upward trend. It is also noteworthy that 64% of Litecoin holders are profitable, as on-chain data shows.

All of the above may suggest that the upward slope of the past few months may develop into a strong uptrend that is likely just around the corner.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Join Telegram

Join Telegram

Bitcoin price got a respite from sideways trading after the US SEC vs. Ripple lawsuit reached a conclusion, for now. The announcement caused Ripple price to double in a few hours, causing other altcoins to also rally from the hype.

Arbitrum and Optimism have long competed for dominance in the Ethereum Layer 2 ecosystem. With Offchain Lab’s release of Arbitrum Orbit, a toolkit for the development of Layer 3 chains, ARB ecosystem expects higher dominance and a large market share in the future.

Ripple's win in the SEC lawsuit has already drawn criticism from the crypto community. Experts speculate that Ripple’s status as a non-security gives XRP and its founders a free pass to dump their token holdings.

The SEC vs Ripple lawsuit outcome fueled a bullish sentiment in the crypto community. Experts are arguing that Coinbase is likely to land a win as the regulator’s argument against the platform’s sale of unregistered securities.

Bitcoin (BTC) price got a respite from sideways trading after the United States Securities and Exchange Commission (SEC) vs. Ripple lawsuit reached a conclusion, for now. The announcement caused Ripple (XRP) price to double in a few hours, causing other altcoins to also rally from the hype.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Menu