Diego Thomazini/iStock Editorial via Getty Images

Diego Thomazini/iStock Editorial via Getty Images

Last November I covered the Grayscale Ethereum Trust (OTCQX:ETHE) for the second time. At the time of publishing Stop Panicking and Grab This Arb, the crypto market was very much dealing with the fallout from the collapse of centralized crypto exchange FTX. Among other crypto declines, the Grayscale funds were being sold off hard and both ETHE and the Grayscale Bitcoin Trust (OTC:GBTC) were trading at 45% discounts to the net asset value (or NAV) of the fund shares.

A lot has happened in the 9 months since that article. Though we currently find ourselves in what is another deep crypto selloff, Grayscale’s lawsuit against the SEC is showing promise and several other firms in traditional finance are applying for spot Bitcoin (BTC-USD) ETFs. There is increasing belief that a spot BTC ETF approval is now a matter of when not if. Should that sentiment be proven correct, the next logical step forward for crypto exposure through “TradFi” institutions would theoretically be Ethereum (ETH-USD). And according to Bloomberg, we’re already seeing indications that an Ethereum futures ETF could be approved by the SEC as early as October.

The regulator isn’t likely to block the products, which would be based on futures contracts for the second-largest cryptocurrency, according to people familiar with the matter. Nearly a dozen companies, including Volatility Shares, Bitwise, Roundhill and ProShares, have filed to launch the ETFs.

It’s important to mention that any impending futures ETF approval does not necessarily mean a spot ETH ETF will be approved as well. I would imagine we’d need to see a spot Bitcoin ETF first and thus I won’t speculate as to when a spot ETH ETF could find its way to the US market. But I do believe the market has yet to price that possibility in to the ETHE shares.

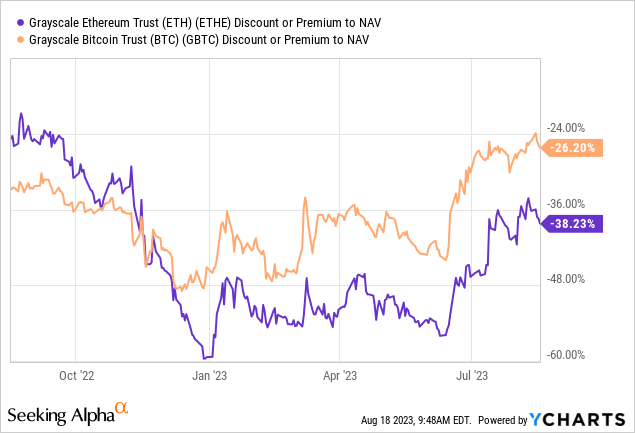

The rising belief that a spot Bitcoin ETF is coming has helped move the discount to NAV in Grayscale’s Bitcoin fund from 45% earlier this summer up to 26% as of article submission. We’ve also seen a bit of relief in the Ethereum Trust NAV discount as well over that time but at 38%, the ETHE NAV discount still has a long way to go to catch GBTC.

We don’t yet have all of the updated 10-Q filings for Grayscale’s single asset funds but most of the 10-Qs for the bigger funds have been released:

Source: Grayscale

In the table above, I’m showing Grayscale’s top five single asset funds by AUM. GBTC, ETHE, and ETCG 10-Qs are all as of Q2-23 while LTCN and BCHG are as of Q1-23. At -26%, ETHE shares have been sold to the largest degree when analyzing year to date holdings change on a percentage basis. This is certainly cause for concern but it also opens up the possibility that the worst could actually be over for ETHE related party selling.

Shares Held

Source: Grayscale

Furthermore, if related parties like Digital Currency Group find that asset liquidations are still necessary, those sales may not actually pressure the price of ETHE lower to the degree that other Grayscale funds could be pressured by related party sales. Related parties have an enormous position in the Ethereum Classic fund. This is also the case for some of the smaller Grayscale funds by AUM. But it is not the case for Ethereum. At just 2.8%, related parties own a relatively small percentage of ETHE shares compared to the firm’s other top 5 funds.

The NAV discount and the related party ownership dynamics are just two of the factors to consider when looking at ETHE. The biggest reason to consider longing ETHE shares is because of the theoretical value of the network where the collateral lives and the price appreciation of that collateral. As a network, Ethereum remains the top smart contract public blockchain network in crypto.

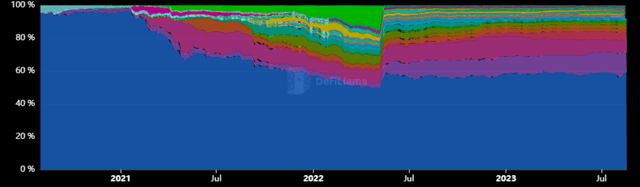

TVL Share By Chain (Ethereum in blue) (DeFi Llama)

TVL Share By Chain (Ethereum in blue) (DeFi Llama)

In the chart above, I’m showing the total DeFi market by blockchain share of TVL per DeFi Llama data. At $22.5 billion in TVL, Ethereum currently commands 58.9% of DeFi TVL at the base layer alone. This is actually ahead of the 49.8% share of TVL back in May of 2022. It should be noted that this May 2022 comp pre-dates the collapse of Terra Luna (LUNC-USD). But even after that major crypto event, Ethereum’s share of TVL at the base layer was 55%.

When we add the scaling/L2 chains to the picture, that’s when we can really see Ethereum’s dominance growth as an ecosystem over the last year or so:

Source: DeFi Llama

As other L1 chains like Solana (SOL-USD), Binance (BNB-USD), and Avalanche (AVAX-USD), have seen share of the DeFi market decline in the last 15 months, the Ethereum ecosystem has seen share go from under 60% to nearly 68%. From where I sit, this is particularly impressive because the L1 chains that have given up share are the ones that have had lower transaction fees at the user level:

365 Day Fees (Token Terminal)

365 Day Fees (Token Terminal)

In the last year, Ethereum has generated roughly $2 billion in fees. This is more than Binance Smart Chain, Tron (TRX-USD), and most of the other L1 chains combined.

There are numerous valid concerns that can be raised about longing ETHE at this time. As mentioned in a previous section, there is forced sale risk due to the amount of ETHE shares that are held by related parties. However, I believe any possible Grayscale fund share selling by DCG or related parties will impact ETHE to a lesser degree than other funds. Much of that selling has likely happened already for ETHE judging by the updated related party holdings from the early-August 10-Q filings.

But ETHE shares also carry underlying asset risk. If the price of ETH goes down, it’s a safe bet that ETHE will decline as well. And there’s always the possibility that ETHE shares could again trade at a lower NAV discount than current levels even if ETH is flat. Finally, with the exception of playing the NAV arb, longing ETHE might ultimately be unattractive because of the in-kind yields that can be generated by staking Ethereum either directly or through a service provider. The ETH collateral held in custody for ETHE shares isn’t actively staked. This means there is an opportunity cost associated with going long ETHE rather than staking ETH directly.

Despite the latest drawdown in Ethereum and the crypto market more broadly, there are a lot of positive signs for the crypto industry. We’ve seen several recent indications that traditional financial firms are more comfortable entering the space. While you won’t get much of an argument from me on the saturation and proliferation of layer 1 smart contract blockchains that have entered the market in recent years, Ethereum is still the leader by several important activity metrics like TVL and network fees.

With the important caveat that crypto is designed to be self-custodied and I consider myself a major proponent of both self-custodial solutions and on-chain activity, if one wants to speculate on the potential upside of ETH as a digital asset, I think ETHE shares offer a really attractive way to do so. Not only can the shares be purchased in tax-advantaged accounts, but they’re still trading at a considerable discount to net asset value.

I believe we’re getting close to an ETH futures ETF. It isn’t illogical to assume Grayscale might prioritize ETF conversion for more of its crypto products if its lawsuit with the SEC is successful. I believe ETHE would be next in line. Patience will be rewarded in my opinion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ETH-USD, ETHE, BTC-USD, GBTC, AVAX-USD, MATIC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.