Cryptocurrencies Price Prediction: Binance, XRP & Bitcoin – European Wrap 10 July – FXStreet

![]() FXStreet Team

FXStreet Team

FXStreet

Peter Brandt, a commodity and foreign exchange trader, compared the discount on Bitcoin and Ethereum prices on Binance to the “popping of a bubble.” Brandt criticized Binance and Executive Changpeng Zhao (CZ), labeling the exchange the “scam of the decade.”

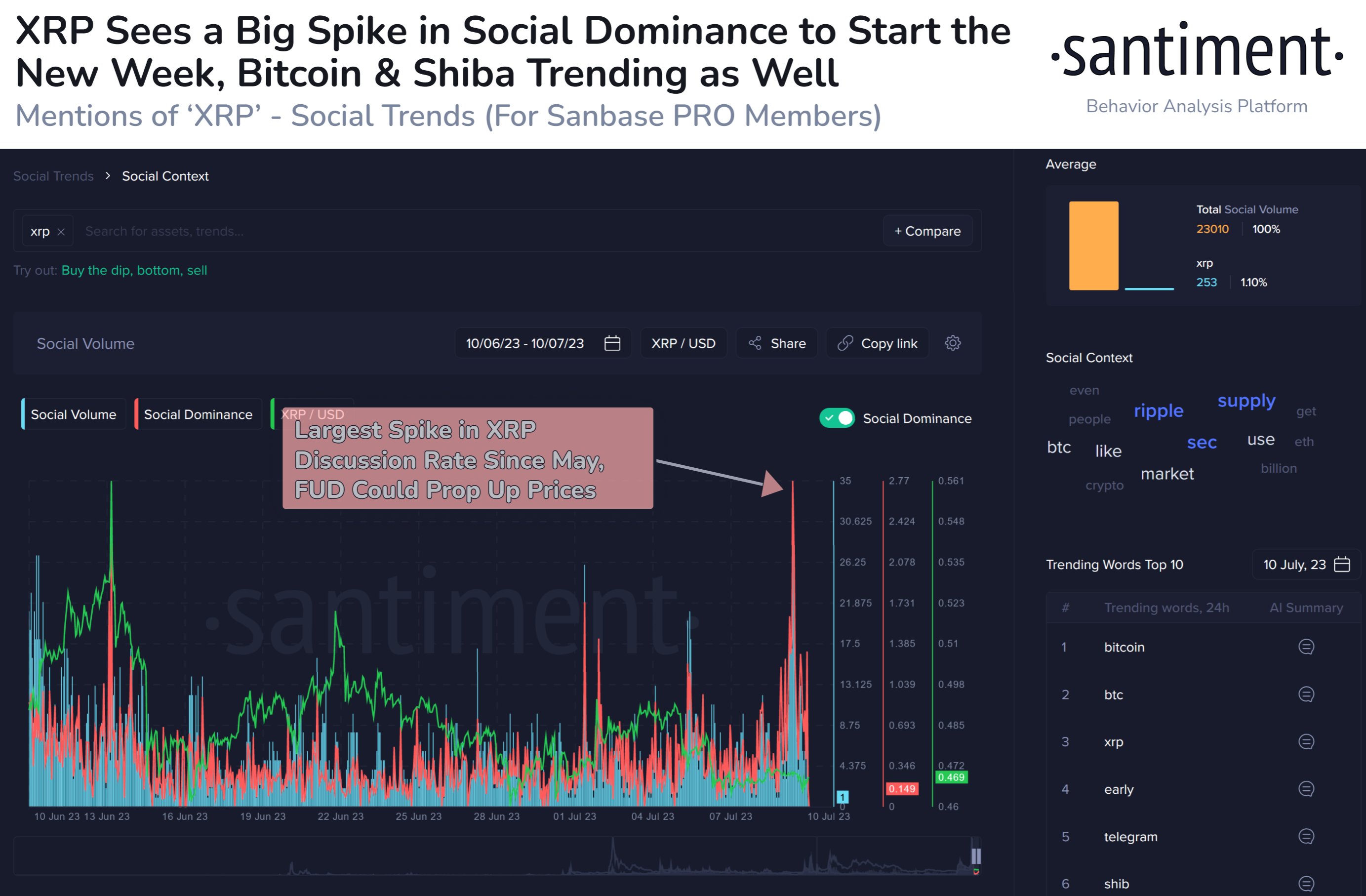

XRP is in the spotlight once again as the community awaits a verdict in the SEC vs. Ripple case. The token noted a spike in its social dominance, an on-chain metric used to measure the mentions of an asset across social media platforms like Twitter.

Crypto market capitalisation has fallen 3% over the past seven days to $1.17 trillion. The Fear and Greed Index is at 56 (greed), having corrected from 62 a week earlier. Capitalisation has stabilised at $1.20 trillion in the first half of the week and at 1.18 in the second half. Capitalisation falls early on Monday, following the downtrend in global equity indices.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Join Telegram

Join Telegram

BTC price continues to move sideways in a tight range with no resolution. However, a closer look at the price action suggests that a steep correction could be on its way. If bears are successful, Ethereum and Ripple could be in trouble as well.

While reeling from the FTX exchange implosion and the Three Arrows Capital crisis, the Monetary Authority of Singapore had successfully maintained a neutral stance on crypto. However, this has likely changed with Temasek’s announcement that the sovereign wealth fund is no longer keen on investing in crypto exchanges.

XRP is in the spotlight once again as the community awaits a verdict in the SEC vs. Ripple case. The token noted a spike in its social dominance, an on-chain metric used to measure the mentions of an asset across social media platforms like Twitter. Typically, this is considered a sign of a recovery, which would mean thatand XRP price is likely to wipe out its losses from June 2023.

Stablecoins with the largest market capitalization in the crypto ecosystem, USD Tether (USDT) and USD Coin (USDC) signal upcoming volatility in Bitcoin and altcoin prices through on-chain metrics.

Bitcoin (BTC) price shows multiple sell signals on the daily chart, hinting at a short-term correction. Although the longer-term outlook remains bullish, the hype generated by multiple US-based companies filing for Bitcoin ETF seems to be waning.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.