![]() Aaryamann Shrivastava

Aaryamann Shrivastava

FXStreet

To the surprise of crypto traders, the past 24 hours turned out to be not exactly what one would have in mind. As the market reacted to the Binance-related news, it also potentially led to an unexpected change in certain cryptocurrencies’ price action resulting in millions of dollars in liquidations.

Apart from Bitcoin, it was Ethereum that stood out as the altcoin with the most liquidation. Being the second biggest cryptocurrency in the world, it is not a surprise, but the volume of long liquidations stood out from normal. Within the past day, over $15 million worth of long liquidations were observed in the case of ETH.

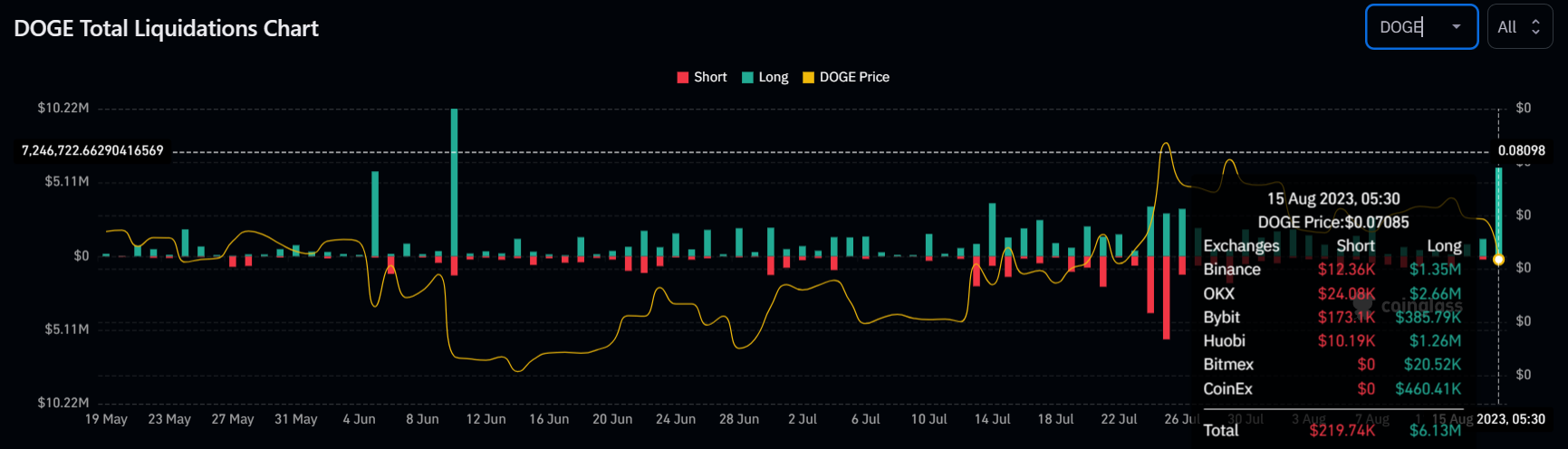

The other major cryptocurrencies that stood out in this regard were Dogecoin, Pepe coin, ApeCoin and Compound. DOGE noted over $6.13 million worth of long liquidations, marking a two-month high, while the volume of PEPE nearly hit $1 million against merely $80,000 worth of short liquidations.

Dogecoin long liquidation

Similarly, APE recorded about $1.44 million worth of long contracts being liquidated, hitting a monthly high, and COMP followed in suit, observing $809,000 in long liquidations. Collectively, the crypto marketnoted over $121 million worth of long liquidations against $10 million in short liquidations within a day.

ApeCoin long liquidations

While the exact reason behind this is unknown, the sudden shift in tone and liquidations is most likely a reaction to FUD. Earlier in the day, Binance’s regulated buy and sell arm, Binance Connect, was announced to face closure. This was confirmed by Binance Smart Chain-based decentralized exchange Biswap that tweeted,

“After a thorough consideration, Binance has made a difficult decision to disable Binance Connect on 15 August due to its provider closing the supporting card payments service. This change aligns with the strategic efforts of Binance to focus on its core businesses.

Considering the price action reaction to the FUD, the crypto market lost about $14 billion in a day, dropping by 1.2% to hit a total market capitalization of $1.12 trillion.

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Join Telegram

Join Telegram

Bitcoin price action remains boring, but certain elements that directly or indirectly affect it are changing slowly. Previous publications have already discussed the slump in Bitcoin price action, the recent surge in Open Interest, and the drop in volatility to all-time lows.

Vitalik Buterin, the Ethereum co-founder, made headlines as he explained that all Layer 2 projects and rollups like Arbitrum and Optimism have a backdoor on Ethereum. Scaling solutions are, therefore, unlikely to be sufficiently decentralized.

Ripple investment products have witnessed an increase in the inflow of capital from institutional investors. While the crypto market remains largely Bitcoin dominant, XRP funds have seen $0.5 million in inflows this week, marking nearly four consecutive months of inflows in Ripple-based investment products.

Binance filed a motion seeking a protective order concerning deposition notices and discovery requests made by the SEC. The exchange states that the financial regulator is asking for communication that includes topics that have nothing to do with customer assets.

Bitcoin price has been moving sideways for nearly 50 days now, with no directional bias in sight. With volatility hitting all-time lows, investors are bored out of their minds and are looking at other avenues for trading opportunities.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.