peshkov

peshkov

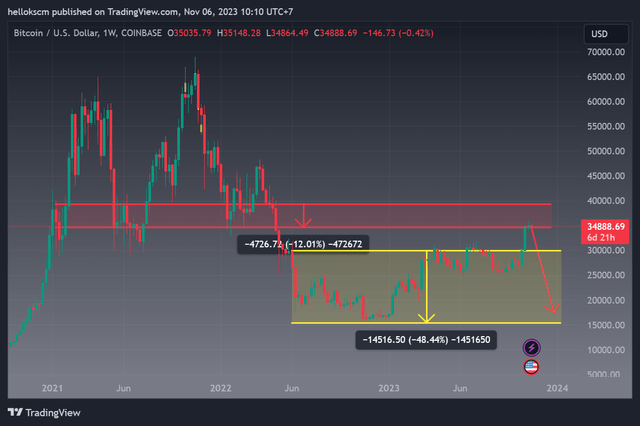

After several months of trading within the price range of $16,000 to $30,000, Bitcoin (BTC-USD) is encountering strong resistance at $35,000 in the weekly time frame. We need to check whether it will break through this resistance to move higher or if it will react and move lower.

Bitcoin is encountering a strong resistance. (Tradingview)

Bitcoin is encountering a strong resistance. (Tradingview)

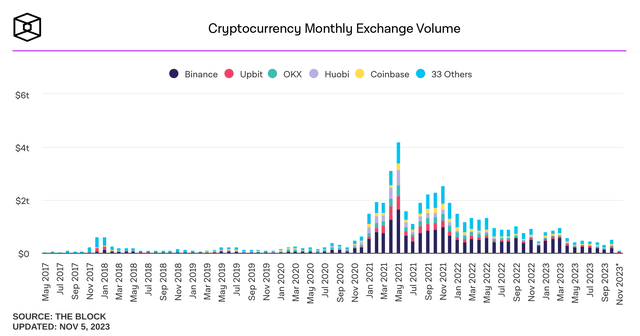

After several gloomy months, there are signs of a resurgence in the daily trading volume of cryptocurrencies on various exchanges. The aggregate trading volume in the spot market across various exchanges has increased sharply.

Daily Exchange Volume (7DMA) (theblock.co), (theblock)

Daily Exchange Volume (7DMA) (theblock.co), (theblock)

The cryptocurrency market has become more vibrant, with October witnessing an increase in monthly spot market volumes across cryptocurrency exchanges compared to the first few months of the year 2023.

Cryptocurrency Monthly Exchange Volume (theblock)

Cryptocurrency Monthly Exchange Volume (theblock)

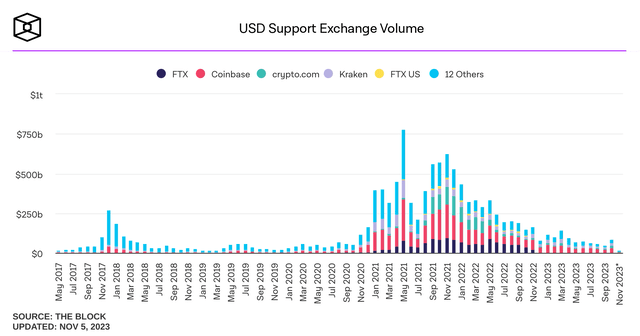

With strong support from the USD, as evidenced by the USD Support Exchange Volume index, liquidity in the cryptocurrency market is further ensured. However, this could also be a sign of approaching selling pressure near the resistance level.

Spot trade volumes for cryptocurrency exchanges with USD support and USD pairs contributing significant volume. (theblock)

Spot trade volumes for cryptocurrency exchanges with USD support and USD pairs contributing significant volume. (theblock)

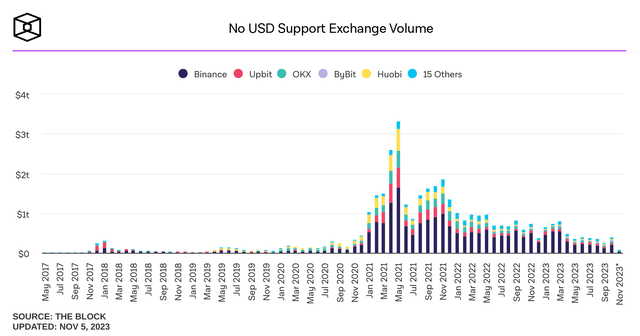

In addition, the trading volume between various cryptocurrencies has also increased, meaning there is trading occurring without the use of USD. This indicates that the liquidity between different cryptocurrencies has significantly increased in October.

Spot trade volumes for cryptocurrency exchanges with no USD support or USD pairs contributing in significant volumes. (theblock)

Spot trade volumes for cryptocurrency exchanges with no USD support or USD pairs contributing in significant volumes. (theblock)

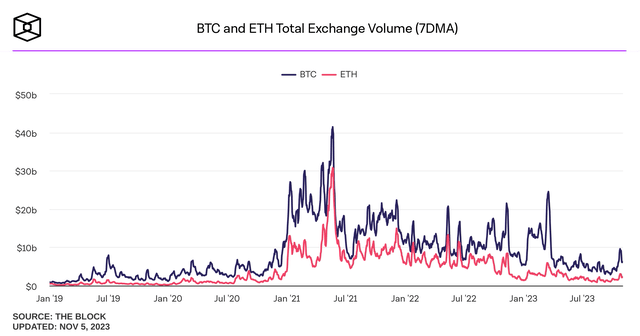

In particular, the total volume of BTC spot trading has also seen a significant increase in October, following several months of a downturn. In simple terms, Bitcoin is being traded more actively in the resistance zone of $30,000 to $35,000.

Spot market total volume for BTC and ETH across all cryptocurrency exchanges. Chart uses 7-day moving average. (theblock)

Spot market total volume for BTC and ETH across all cryptocurrency exchanges. Chart uses 7-day moving average. (theblock)

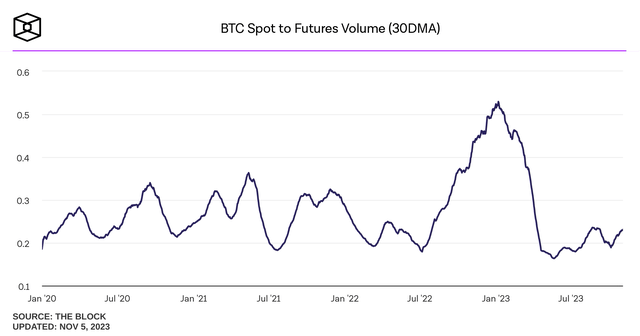

When examining the ratio of daily spot market total volume for BTC to BTC futures trading volume, it’s important to note that both volume calculations incorporate data from the largest exchanges with reliable reporting of exchange volume metrics. This indication shows that spot traded volume has increased relative to future trading volume. In other words, The price of Bitcoin would be influenced by the spot market.

Daily spot market total volume for BTC divided by BTC futures trading volume, Both volume calculations include the largest exchanges with trustworthy reporting of exchange volume metrics. (theblock)

Daily spot market total volume for BTC divided by BTC futures trading volume, Both volume calculations include the largest exchanges with trustworthy reporting of exchange volume metrics. (theblock)

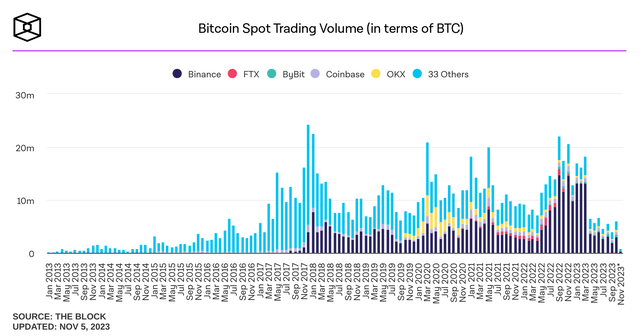

Looking at the volume for all BTC pairs, in BTC, on exchanges from The Block’s Legitimate Index, We can see that the liquidity of BTC in cryptocurrency trading significantly increased in October. In other words, the volume of various cryptocurrencies being traded through BTC has risen. However, when compared to previous years, it may still be relatively low.

Bitcoin Spot Trading Volume (in terms of BTC) (theblock)

Bitcoin Spot Trading Volume (in terms of BTC) (theblock)

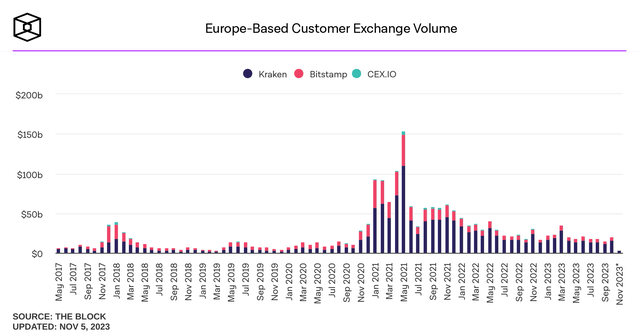

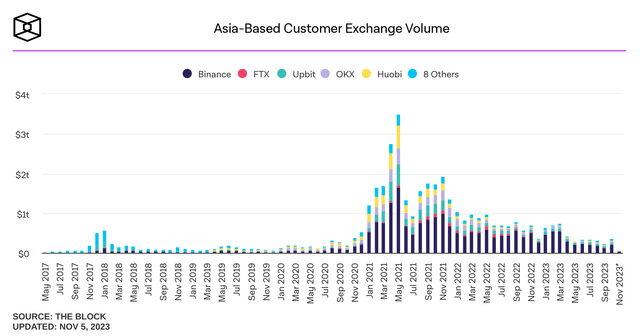

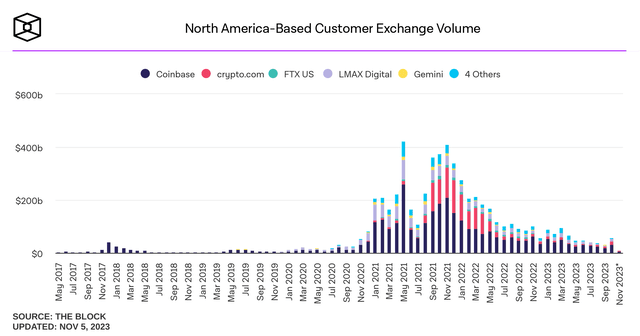

Looking at region-based customers, the number of traders shows signs of an increase in October, but when compared to previous years, it remains relatively low.

We determined where most visitors to exchange websites were coming from based on data from SimilarWeb. These are the monthly volumes for exchanges that had a clear dominance in Europe. (theblock)

These are the monthly volumes for exchanges that had a clear dominance in Asia. (theblock)

These are the monthly volumes for exchanges that had a clear dominance in North America. (theblock)

These are the monthly volumes for exchanges that had a clear dominance in South America. (theblock)

We determined where most visitors to exchange websites were coming from based on data from SimilarWeb. These are the monthly volumes for exchanges that had a clear dominance in Europe. (theblock)

These are the monthly volumes for exchanges that had a clear dominance in Asia. (theblock)

These are the monthly volumes for exchanges that had a clear dominance in North America. (theblock)

These are the monthly volumes for exchanges that had a clear dominance in South America. (theblock)

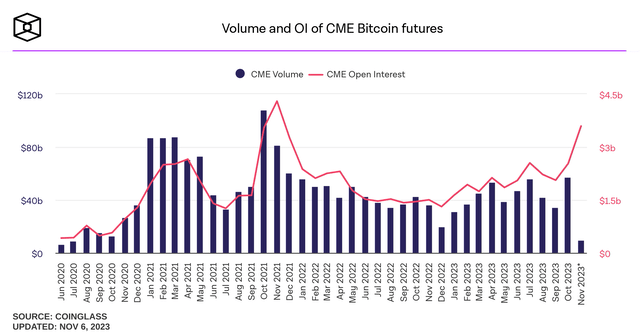

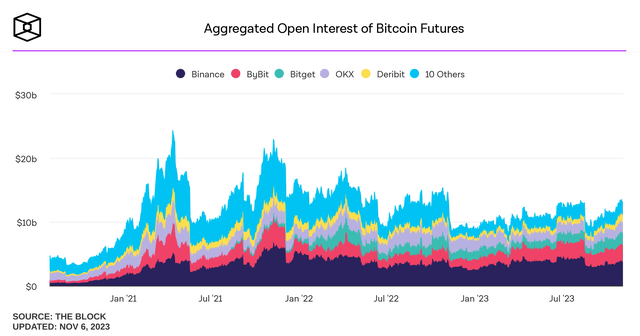

At the same time, short liquidation and CME open interest and open interest across crypto exchanges have increased. This leads to the prediction that there may be a subsequent long liquidation.

Daily liquidations of futures short positions on crypto exchanges. Includes Binance, BitMEX, Bybit, FTX, Huobi, OKEx. On this chart, the start of the day is 4 pm UTC. (theblock)

Aggregated monthly trading volumes of CME bitcoin futures, estimated in dollar terms using the price of daily spot and the daily volume of contracts traded. Open interest is the average of the month. (theblock)

The total Bitcoin futures open interest across cryptocurrency exchanges, where open interest is calculated as the estimated notional value of all open futures positions, or the aggregate dollar value of outstanding contract specified BTC deliverables. Includes the largest exchanges with trustworthy reporting of exchange volume metrics. (The Block)

Daily liquidations of futures short positions on crypto exchanges. Includes Binance, BitMEX, Bybit, FTX, Huobi, OKEx. On this chart, the start of the day is 4 pm UTC. (theblock)

Aggregated monthly trading volumes of CME bitcoin futures, estimated in dollar terms using the price of daily spot and the daily volume of contracts traded. Open interest is the average of the month. (theblock)

The total Bitcoin futures open interest across cryptocurrency exchanges, where open interest is calculated as the estimated notional value of all open futures positions, or the aggregate dollar value of outstanding contract specified BTC deliverables. Includes the largest exchanges with trustworthy reporting of exchange volume metrics. (The Block)

From the arguments above, we can see that market sentiment is still not very positive, with a significantly lower number of participants compared to previous years. Furthermore, the trading volume has increased as Bitcoin encounters strong resistance in the price range of $30,000 to $35,000. This suggests that Bitcoin may likely continue to move lower to retest the previous bottom at $16,000 in the mid-term. However, there may be positive signs for the upcoming halving event in the long term. Historically, Bitcoin prices often move higher after it’s halving as miners receive fewer rewards. I would write an article with forward-looking views for this special event if I think that Bitcoin price might go up.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.