![]() Akash Girimath

Akash Girimath

FXStreet

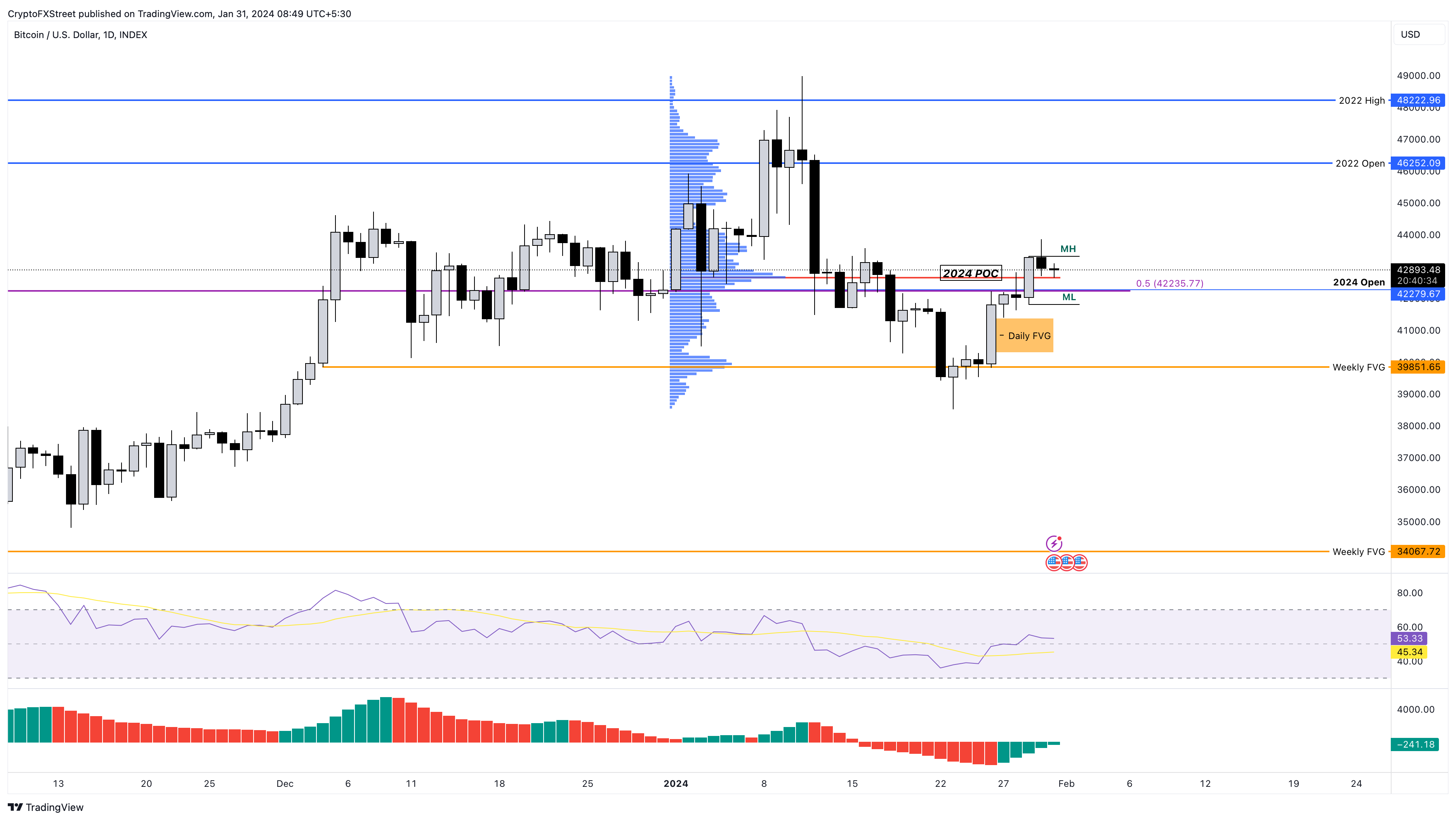

Bitcoin (BTC) price shot up 3% on Monday but has since undone most of the gains and currently trades around $42,762. But a few things need to happen before BTC shows its bullish hand and resumes the uptrend.

Also read: Week Ahead: Bitcoin price likely to support these altcoin narratives this week

Bitcoin price created the Monday’s range, extending from $41,807 to $43,324. The most common trade idea is to short BTC after a sweep of Monday’s high and book profits at Monday’s low.

Read more: Bitcoin Weekly Forecast: As monthly close draws near, significance of $43,750 grows

Here are a few key levels to watch if one is in this trade.

In addition to these levels, the daily imbalance, extending from $41,396 to $40,288, is also a key area to watch. Imbalances or gaps are formed when the asset moves rapidly up or down due to inefficient order flow. These gaps are often revisited by the asset to rebalance and serve as support or resistance, depending on the type of imbalance.

In BTC’s case, the imbalance was formed due to a spike in buying pressure, so a retracement into this area will be a good place for sidelined buyers to open a long position.

While this short-term play shows promise of a quick upside, investors need to be mindful of the big picture as well. As mentioned in a previous publication, Bitcoin price needs to produce a daily candlestick close above $48,222 to sustain the uptrend outlook.

Supporting the bullish outlook are the Relative Strength Index (RSI) and the Awesome Oscillator (AO) momentum indicators. The RSI has overcome the 50 mean level and is retesting it as a support, which is a bullish indication. The AO is close to flipping above the zero level, which shows a shift in momentum favoring bulls.

In such a case, Bitcoin price could easily overcome the $48,222 level and potentially retest the $50,000 psychological level.

BTC/USDT 1-day chart

However, a potential spike in selling pressure that pushes Bitcoin price to slice through the $41,396 to $40,288 imbalance would denote a weak bullish camp. If this trend continues and leads to the production of a daily candlestick close below $39,851, it would produce a lower low and invalidate the bullish thesis for BTC.

In such a case, a steeper correction could be anticipated by investors, as pointed out in a previous publication. The $34,067 and $32,293 support levels will be where the Bitcoin price would likely consolidate and rethink a bounce.

Read more: Bitcoin Weekly Forecast: Will BTC correct to $35k or continue bull run without steep corrections?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Join Telegram

Join Telegram

The Office of the Privacy Commissioner of Hong Kong has investigated Sam Altman’s Worldcoin project’s six office locations. The independent body alleged “serious personal data privacy risks,” and warned users to remain vigilant about the Worldcoin project.

Bitcoin has observed a decline in its social volume and dominance as seen on the on-chain metric provider Santiment. A decline in social volume indicates that market participants are discussing “Bitcoin” relatively less, and discussions of other altcoins are taking precedence.

Bitcoin’s (BTC) price is recovering this week, trading shy of the $43,000 level on Wednesday’s European morning, after its recent drop to $38,555. Outflows from Grayscale’s GBTC have slowed down this week, easing the selling pressure for Bitcoin and likely catalyzing its recent recovery.

Ethereum network’s next major upgrade after its Merge is Dencun. The upgrade will implement several Ethereum Improvement Proposals, the most notable of which is EIP-4844. The improvement proposal, better known as protodanksharding, will reduce transaction costs for Layer 2 chains.

Bitcoin currently trades around $41,094 after dropping 4.60% on Thursday, putting an end to the $2,000 trading range. This move comes after Adam from GeeksLive noted that the volatility level of BTC dropped to a new low in a month.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.