Bitcoin price recovers as on-chain metrics point at potential BTC rally – FXStreet

![]() Ekta Mourya

Ekta Mourya

FXStreet

Bitcoin (BTC) price tested resistance at $43,000 on Friday, recovering from declines earlier this week, in a sign of increasing buying pressure after a choppy week. Some of the asset’s on-chain metrics support the thesis of further price gains ahead, although Bitcoin price has been moving broadly sideways for the last two months.

Also read: Bitcoin price scenarios to consider with approaching BTC halving event%20[10.54.12,%2002%20Feb,%202024]-638424539550370748.png)

Whale transaction count and Network Realized Profit/Loss. Source: Santiment %20[11.15.20,%2002%20Feb,%202024]-638424539830392348.png)

BTC Social dominance and price. Source: Santiment

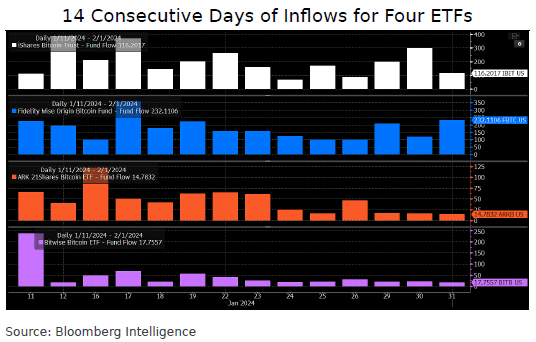

Inflows to BTC ETFs for 14 consecutive days. Source: Bloomberg Intelligence

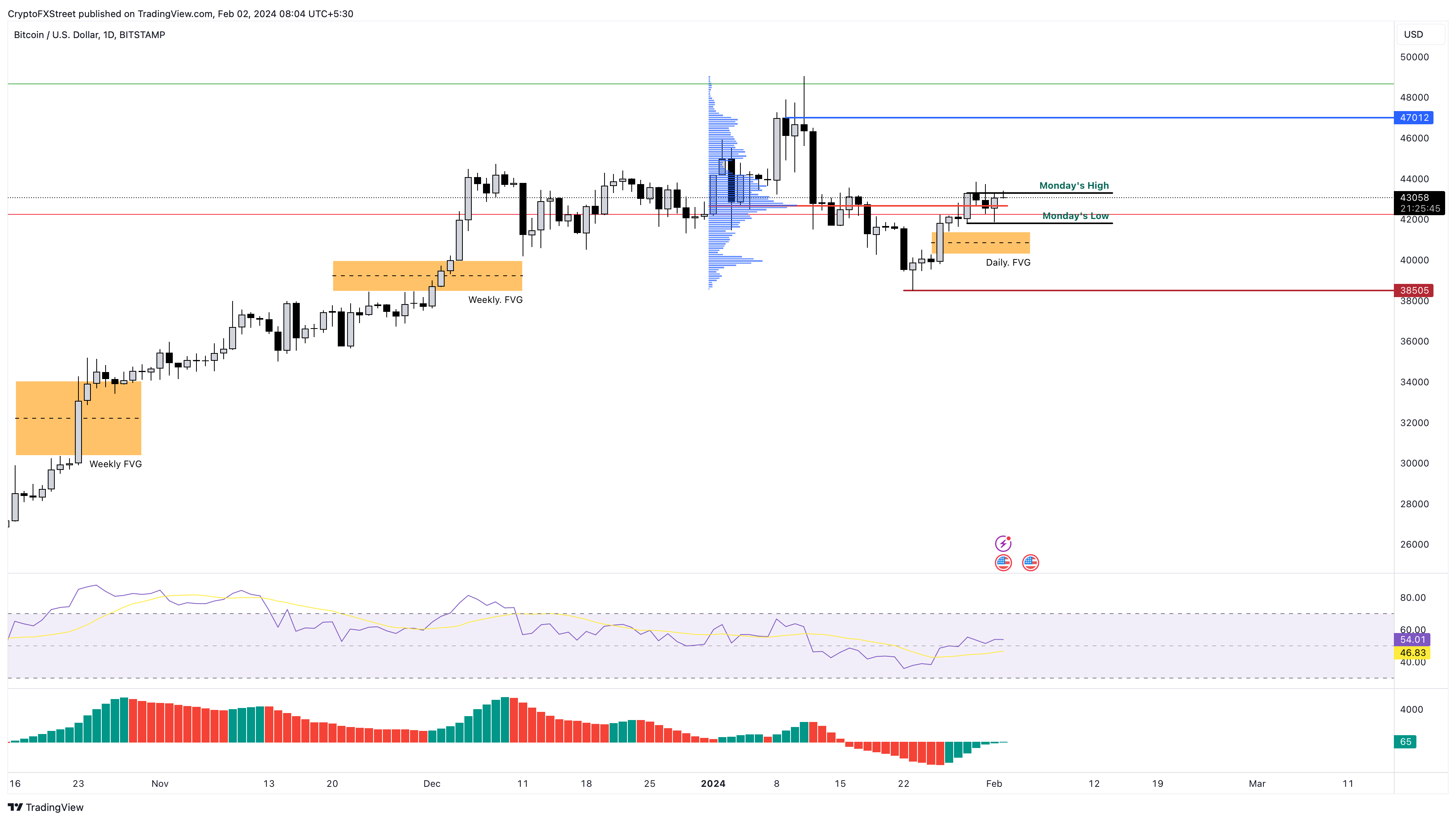

Akash Girimath, technical analyst at FXStreet, notes that Bitcoin price shows no signs of a directional bias in the short-term, the asset is trading around the $43,000 level. Girimath argues that on-chain metrics show clear bullish signs, and that BTC could potentially kick-start a bull run.

Girimath says two scenarios could play out. In the first case, Bitcoin price uptrend could continue after January’s swing low at $38,505. Alternatively, Bitcoin price could correct to the $34,000 level. The analyst notes that traders are expecting a correction that flushes out late long positions and pushes BTC to the $34,000 to $35,000 region. But this correction is highly unlikely, he said.

On the daily timeframe, if Bitcoin price dips into the daily imbalance zone between $41,396 to $40,278, its reaction to the $40,000 region could determine where BTC is headed next. Strong buying pressure has the potential to push Bitcoin to a higher high above $44,000, a moderate buy signal for traders.

BTC/USD 1-day chart

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Join Telegram

Join Telegram

Crypto research firm Chainalysis recently concluded research on “pump and dump” schemes that have plagued the crypto ecosystem. Pump and dumps have made a resurgence with rug pulls on Coinbase’s Base chain and Solana ecosystem’s meme coins.

AAVE price declined in the past week and a further correction is likely, according to on-chain metrics. Two key metrics, the supply of AAVE on exchange wallets and the Network Realized Profit/Loss metric paints a bearish picture for the DeFi token.

Bitcoin price tests resistance at $43,000, recovering from a week-long slump. Bitcoin on-chain metrics signal a likelihood of a BTC price rally. BTC profit-taking by whales has declined, paving the way for extended price gains.

Solana ecosystem’s meme coins are hit by a correction on Friday after posting massive weekly gains. Solana-based meme coins garnered interest from large wallet addresses in January, with big wallets booking millions of dollars in profits trading tokens like Dogwifhat (WIF).

Bitcoin (BTC) price shows no signs of directional bias in the short term as it trades around $43,000. But the on-chain metrics reveal a clear bullish signal that could potentially kick-start the bull run.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.